Va Tax Military Retirement

military wallpaperUp to 24000 of military retirement pay is exempt for retirees age 65 and older. And 7500 for military retirees under age 55 increasing to 10000 in 2021 and 15000 in 2022 and 2023.

Is Military Retirement Income Taxable In North Carolina

Is Military Retirement Income Taxable In North Carolina

For every 1 over 15000 the deduction is reduced by 1.

Va tax military retirement. 16 States With Special Provisions Or Other Consideration For Military Retirement Pay. They will also withhold taxes from your pension just like they would withhold taxes from your active duty pay. Military personnel stationed inside or outside Virginia may be eligible to subtract up to 15000 of military basic pay received during the taxable year provided they are on extended active duty for more than 90 days.

The following states have no specific state income tax exemption for military retirement pay. Virginia Taxes on Retired Military Pay. All the military retirement pay is exempted from all income taxes in Alabama No license fees for vehicles owned by disabled veterans paid for by VA Grant When it comes to state employment veterans who have been honorably discharged are given 5 points bonus on any examination scores.

In other words a 40 disability rating doesnt mean 40 of your retirement pay is tax free. Just like the federal government Virginia will tax it like it is income. The subtraction is reduced when military pay exceeds 15000 and is fully phased out when pay reaches 30000 ie for every dollar that military basic pay exceeds 15000 the subtraction is reduced by one dollar.

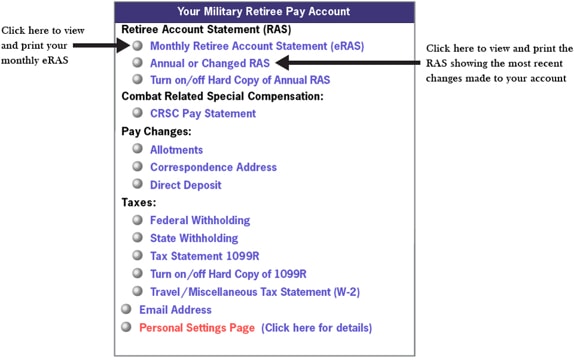

If your retired pay is non-taxable your CRDP is also non-taxable. CRDP is a restoration of your retired pay not a separate entitlement. Concurrent Retirement Disability Payments CRDP.

Since certain states tax military retirement income at different rates the amount that ends up in your pocket varies from state to state just like veterans property tax exemptions. You must be on extended active duty for more than 30 days. Up to 15000 of military basic pay received during the taxable year may be exempted from Virginia income tax.

If you are a resident of Virginia you may be able to subtract up to 15000 of military pay. For example if your basic pay is. Virginia also has relatively low retirement taxes.

If the VA increases your disability rating you may be eligible to claim a federal tax refund in the year when the VA takes the action. It means you receive tax-free compensation from the VA at the 40 rate and your military retirement pay is deducted by that amount. 4 States That Do Fully Tax Military Retirement Pay.

Up to 2000 of retirement income is exempt for taxpayers under age 60. Learn more about Virginia Taxes on Retired Military Pay Virginia Income Tax Exemption on Retired. Therefore if your retired pay is taxable so is any CRDP payments you receive.

Lets look at an example. 20000 for those ages 55 to 64. Utah 65 and older may claim a non-refundable tax credit of up to 450 Vermont.

For every 100 of income over 15000 the maximum subtraction is reduced by 100. Other types of retirement income such as pension income and retirement account withdrawals are deductible up to 12000 for seniors. Lets say our retiree earns a monthly retirement check of 2000.

If you receive or the spouse of a military retiree receives military retirement income you will be able to subtract up to 5000 with an increase to the first 15000 for individuals who are at least 55 years old on the last day of the taxable year of your military retirement income from your federal adjusted gross income before determining your Maryland tax. A few states do not tax military pensions but Virginia isnt one of them. The eight states that do tax military retirement pay are California Montana New Mexico North Dakota Rhode Island Utah Vermont and Virginia.

Military retirement pay is subject to tax as income. Up to 2000 of military retirement excluded for. If your total military income is more than 30000 you do not qualify for the deduction.

If youre a combat-disabled veteran being granted Combat-Related Special Compensation CRSC after an award for Concurrent Retirement and Disability you may be eligible for a tax refund in the year the CRSC. Take a look at this chart to see if youre receiving all the tax benefits you should be. The problem is they tend to under withhold - by a lot.

Military Retirement Pay Income Tax Deduction. Military retirees ages 55 - 64 can exclude up to 20000 in any one tax year from their retirement pay those 65 and over can exclude up to 24000. As described below Virginias sales taxes and property taxes are also quite low.

Up to 3500 is exempt Colorado. Social Security retirement benefits are not taxed in Virginia. For every 100 of income over 15000 the maximum subtraction is reduced by 100.

Military retirement pay is partially taxed in. Start my VA loan with Veterans United Home Loans -- the nations 1 VA lender. However other retired veterans do pay tax on their military pensions.

Congressional Medal of Honor recipients dont pay Virginia tax on income from a military retirement plan. Since tax codes vary from state to state and can change from year to year its a good idea to consult with a tax professional before you start packing to move to a non-taxing state. Up to 15000 of military basic pay may be exempted from Virginia income tax.

Federal Taxes On Veterans Disability Or Military Retirement Pensions The Official Army Benefits Website

Federal Taxes On Veterans Disability Or Military Retirement Pensions The Official Army Benefits Website

8 Of The Best States For Military Retirees 2021 Edition Ahrn Com

8 Of The Best States For Military Retirees 2021 Edition Ahrn Com

Double Bonus Military Retirees Can Receive Retirement And Va Disability Benefits Hill Ponton P A

Double Bonus Military Retirees Can Receive Retirement And Va Disability Benefits Hill Ponton P A

States That Don T Tax Military Retirement Pay Rapidtax Military Retirement Pay Military Retirement Retirement

States That Don T Tax Military Retirement Pay Rapidtax Military Retirement Pay Military Retirement Retirement

Can You Receive Va Disability And Military Retirement Pay Cck Law

Can You Receive Va Disability And Military Retirement Pay Cck Law

Moaa Sorting Out Retired Pay Va Compensation And Tax Issues

Moaa Sorting Out Retired Pay Va Compensation And Tax Issues

10 Best Places For Military Retirement In The U S Extra Space Storage Best Places To Retire Best Places To Live Family Friendly Activities

10 Best Places For Military Retirement In The U S Extra Space Storage Best Places To Retire Best Places To Live Family Friendly Activities

Military Retirement Pay Va Org

Military Retirement Pay Va Org

Virginia Retirement Tax Friendliness Smartasset

Virginia Retirement Tax Friendliness Smartasset

2021 Retired Military Pay Dates Annuitant Pay Schedule

2021 Retired Military Pay Dates Annuitant Pay Schedule

Va Disability Compensation Affects Military Retirement Pay

Va Disability Compensation Affects Military Retirement Pay

Moaa Tax Update The Latest From 5 States On Work To Exempt Military Pensions

Moaa Tax Update The Latest From 5 States On Work To Exempt Military Pensions

How Does Va Disability Pay Affect Social Security Payments The Answer Depends Greatly On Va Disability Disability Benefit Social Security Disability Benefits

How Does Va Disability Pay Affect Social Security Payments The Answer Depends Greatly On Va Disability Disability Benefit Social Security Disability Benefits

Military Medical Retirement Pay Chart 2020 Va Disability Medical Retirement Va Benefits

Military Medical Retirement Pay Chart 2020 Va Disability Medical Retirement Va Benefits

Military Retirement Pay Pension Benefits Explained

Military Retirement Pay Pension Benefits Explained

Crdp And Crsc Concurrent Receipt Explained Cck Law

Crdp And Crsc Concurrent Receipt Explained Cck Law

Waive Va Compensation For Military Pay Va Form 21 8951

Waive Va Compensation For Military Pay Va Form 21 8951

Disability Compensation Pensions Virginia Department Of Veterans Services

Disability Compensation Pensions Virginia Department Of Veterans Services

Https Myarmybenefits Us Army Mil Benefit Library State Territory Benefits Virginia