Military Disability Retirement Tax Free

military retirement wallpaperLets say our retiree earns a monthly retirement check of 2000. The combat-disabled veteran applying for and being granted Combat-Related Special Compensation after an award for Concurrent Retirement and Disability.

Military Divorce Series Military Disability In Divorce By Anderson Boback Family Law Medium

Military Divorce Series Military Disability In Divorce By Anderson Boback Family Law Medium

In other words a 40 disability rating doesnt mean 40 of your retirement pay is tax free.

Military disability retirement tax free. Three Military Retirement Categories. Military retirement uses years of service not necessarily wartime. Although military retirement pay is subject to federal income tax its not subject to FICA Social Security deductions.

Generally Social Security Disability Benefits SSDI arent taxable unless you have substantial additional income more than 25000 for an individual or 32000 for married filers. Military retirement is taxable but a VA pension is tax-free. 12500 if 60 or older.

The disability from the VA is not taxable and not reportable as you know. Equals Initial amount of tax-exempt gross pay Step 2. For Social Security tax purposes military retirement pay is not considered earned income and no Social Security payroll taxes also known as Federal Insurance Contributions Act FICA taxes are.

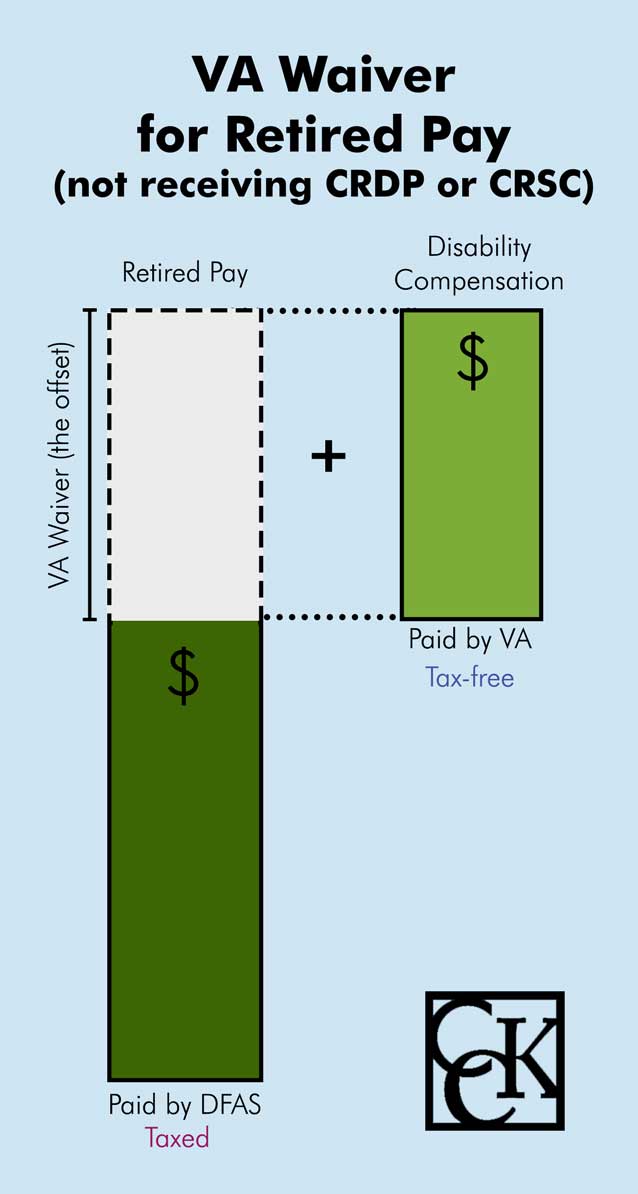

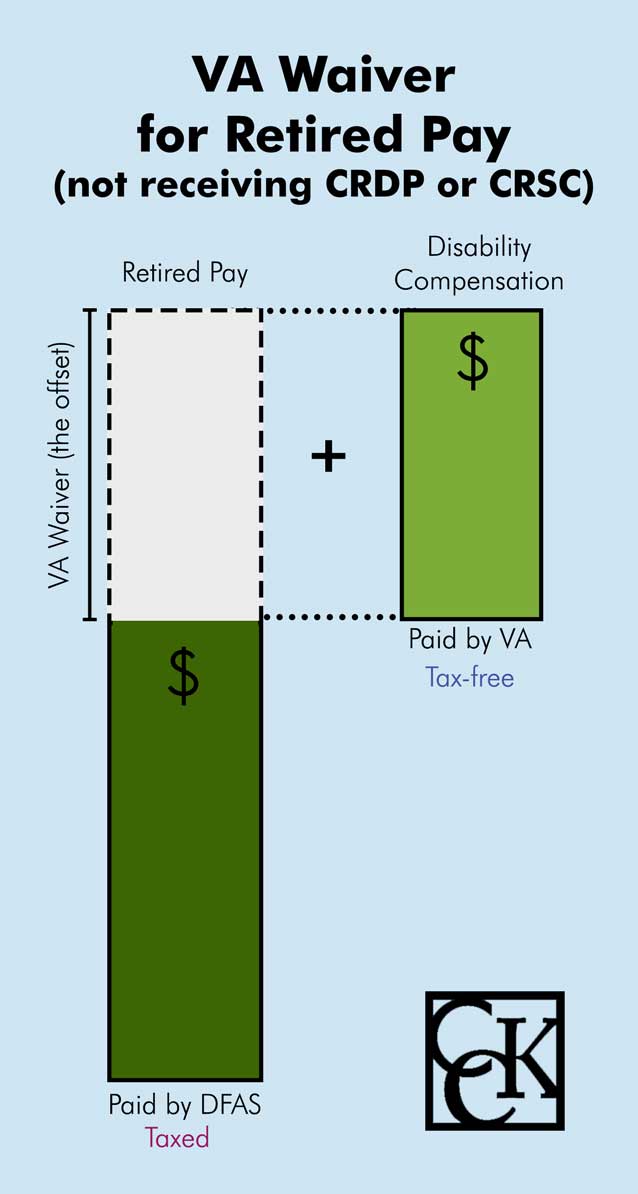

As a military retiree you may be required to waive a portion of your military retirement to receive these tax-free benefits. X times applicable Cost-Of-Living-Adjustment COLA. But a VA pension is based on wartime service and financial need.

Yes the retirement portion is taxable and is reported to you on your 1099-R. Its also tax free if the military makes a determination that your medical condition is combat related. The military retirement system is well documented and understood in general but some mystery surrounds medical disability retirement even among currently serving troops.

Up to 2000 of military retirement excluded for individuals under age 60. There are exceptions for those. Military disability retirement pay is compensation for retirement that was due to an illness or injury resulting from active service.

Active component military retirement. X times Active Duty pay at the time of retirement. A tax-exempt amount of gross pay determined by the following formula.

Some states offer exclusions for military retirement pension or for disabled taxpayers. Initial amount of tax-exempt gross pay. The three basic retirement categories for military members include.

Military disability retirement pay not to be confused with Department of Veterans Affairs benefits may be partially taxable or not taxable at all. Idaho Up to 34332 of qualified retirement benefits including military retirement pay may be exempt for single filers up to 51498 for joint filers 65 or older or disabled and age 62 or older are excluded from state taxes. However military disability retirement pay and.

Disabled veterans may be eligible to claim a federal tax refund based on. It is a tax free entitlement that you will be paid each month along with any retired pay you may already be receiving. Combat Related Special Compensation CRSC is a program that was created for disability and non-disability military retirees with combat-related disabilities.

It means you receive tax-free compensation from the VA at the 40 rate and your military retirement pay is deducted by that amount. However Military Disability Retirement pay could be taxable if reported on form 1099-R. Taxpayers over 62 or permanently disabled may be eligible for a 4000 exclusion of retired pay.

In our example lets say it took three. Special Tax Considerations for Veterans. Which state return do you file.

Medical retirement pay is tax free if you joined the military before September 24 1975. This reduction in military retirement pay is commonly referred to as a. An increase in the veterans percentage of disability from the Department of Veterans Affairs which may include a retroactive determination or.

Reserve component military. Military OneSource is a program funded by the Department of Defense that provides a range of free resources for Veterans and their immediate family up to 365 days after separation or retirement from the military. For those above a 50 percent disability rating the VA disability compensation remains tax free while the military retirement benefits are still fully taxable.

Since 2004 however their military retirement pay has been reduced to 2000 per month taxable and they receive the 500 disability payment from the VA. Lets look at an example. Military retirement pay based on age or length of service is considered taxable income for Federal income taxes and most state income taxes.

Military not VA disability percentage.

Taxable Income From Retired Pay Military Com

Taxable Income From Retired Pay Military Com

Military Medical Retirement Pay Chart 2020 Va Disability Medical Retirement Va Benefits

Military Medical Retirement Pay Chart 2020 Va Disability Medical Retirement Va Benefits

Va Disability In A Divorce Military Divorce Guide

Va Disability In A Divorce Military Divorce Guide

Tax Tips For Veterans And Military Personnel

Tax Tips For Veterans And Military Personnel

Va Disability Compensation Vs Pension Va Disability Pensions Pension Benefits

Va Disability Compensation Vs Pension Va Disability Pensions Pension Benefits

2021 Va Service Connected Disability Compensation Rate Charts

2021 Va Service Connected Disability Compensation Rate Charts

Social Security Disability For Veterans Military Benefits

Social Security Disability For Veterans Military Benefits

Crdp And Crsc Concurrent Receipt Explained Cck Law

Crdp And Crsc Concurrent Receipt Explained Cck Law

Military Retirement Calculators Military Benefits

Military Retirement Calculators Military Benefits

Va Disability Rates 2020 S Updated Pay Chart Military Disability Disabled Veterans Benefits Va Disability

Va Disability Rates 2020 S Updated Pay Chart Military Disability Disabled Veterans Benefits Va Disability

Differences Between Military Va Disability Ratings Military Benefits

Differences Between Military Va Disability Ratings Military Benefits

Can You Receive Va Disability And Military Retirement Pay Cck Law

Can You Receive Va Disability And Military Retirement Pay Cck Law

Double Bonus Military Retirees Can Receive Retirement And Va Disability Benefits Hill Ponton P A

Double Bonus Military Retirees Can Receive Retirement And Va Disability Benefits Hill Ponton P A

Military Retirement Pay Va Org

Military Retirement Pay Va Org

Federal Taxes On Veterans Disability Or Military Retirement Pensions The Official Army Benefits Website

Federal Taxes On Veterans Disability Or Military Retirement Pensions The Official Army Benefits Website

Tax Guide For Military Veterans Moneygeek

Tax Guide For Military Veterans Moneygeek

List Of Benefits Due To Service Connected Disability Veterans Resources Disabled Veterans Benefits Va Disability Benefits Veterans Benefits

List Of Benefits Due To Service Connected Disability Veterans Resources Disabled Veterans Benefits Va Disability Benefits Veterans Benefits

Va Disability Compensation Affects Military Retirement Pay

Va Disability Compensation Affects Military Retirement Pay

Is My Disability Income Taxable The Official Blog Of Taxslayer

Is My Disability Income Taxable The Official Blog Of Taxslayer

How Does Va Disability Pay Affect Social Security Payments The Answer Depends Greatly On Va Disability Disability Benefit Social Security Disability Benefits

How Does Va Disability Pay Affect Social Security Payments The Answer Depends Greatly On Va Disability Disability Benefit Social Security Disability Benefits